Tip #1: Tribology - Assume All Hydraulic Components are Designed EquallyBelieve it or not, maintenance begins during the design phase. Moving parts create friction, and friction can lead to wear, ending in premature failure, especially when tribology is ignored…

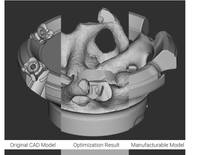

Advanced design software supports growth of additive manufacturing applications in the oil and gas industryAdditive manufacturing (AM, aka 3D printing) is beginning to impact product-development strategies in the oil and gas industry just as…

Singapore's Keppel O&M has received orders from Japan's FPSO leasing company MODEC to deliver components for two FPSO units. The orders are worth S$73 million (USD52,5 million) in total.In Singapore, Keppel Shipyard will fabricate, complete…

Copenhagen Subsea launched a new powerful Remotely Operated Vehicle (ROV), specifically developed for the offshore industry. The ROV is based on Copenhagen Subsea’s rim-driven thruster technology and is designed to be robust and reliable in…

Offshore well integrity company Unity has signed a contract to maintain wellhead equipment across Spirit Energy's twelve offshore platforms.The platforms are located in the East Irish Sea, Southern North Sea and the Dutch sector of the North Sea…

Tidal energy developer Minesto has so far felt no effect of the coronavirus pandemic on the inflow of components for its tidal project in the Faroe Islands, but the company said it was watching the situation closely. “Minesto is closely following…

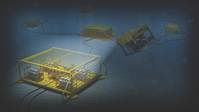

In November 2019 ABB announced the commercial availability of its new subsea power distribution and conversion technology system. Jointly developed with Equinor, Chevron and Total, the tech aims to see the majority of the world’s offshore hydrocarbon…

Ensuring assets remain safe and sustainable through quantitive engineering analysisAs the world continues to demand energy sources, there is mounting pressure on hydrocarbon producers to find new reserves and extract more from existing assets…

Singapore-based offshore rig builder Keppel O&M is working on a system that will enable it to 3D print offshore grade materials, to speed up production and lower cost. The company has teamed up with local university and research and technology…

US-based lifting and rigging accessories manufacturer Crosby has completed the acquisition of offshore mooring company Feubo.The purchase includes the Feubo facility located in Hattingen, Germany that will become Crosby’s center of excellence for mooring components…

Sif Holding, the manufacturer of large steel tubulars, has entered into exclusive negotiations for the delivery of 33 monopiles and 33 Transition pieces (25 KTon steel) for an offshore wind project in Japan.The current state of negotiations has led to a pre- order of the steel for the project…

Seatools offers a new range of subsea hydraulic power units (SHPUs) which come as true plug-and-play solutions.“We believe this new product range proposes a unique offering,” said Johan Sol, Business Development Manager at Seatools. “Complementing…

PT. Dalaz Teknik Utama used a 12t capacity Radiolink plus Straightpoint (SP) load cell and a Crosby shackle of the same capacity to complete a series of tests during fabrication of a power generator module at a Wasco Energy fabrication yard in Indonesia…

Woodside Petroleum Ltd, Australia's top independent gas producer, said on Monday it would invest in a pipeline for the Pluto-North West Shelf (NWS) Interconnector, enabling the optimization of gas processing from its offshore fields.The Interconnector…

Sembcorp Marine earns 3D printing certifications for parts used in construction and repairsThese certifications will help the Group unlock significant efficiencies and reduce supply chain risksSingapore-based Sembcorp Marine has received certifications…

AOG Digital E-News is the subsea industry's largest circulation and most authoritative ENews Service, delivered to your Email three times per week